Aug 22, 2012 Accounting for Software Development Costs (ERP Projects) Capitalization IFRS and US GAAP. IFRS does not address software development costs directly and some IFRS interpreters actually take the position that costs associated with internally developed software should not be capitalized. For example, the acquisition cost, delivery charges, installation fees and other setup costs fall under capitalization rules. Other projects - such as building facilities or building - can capitalize other costs, such as direct labor or materials acquisition associated with the project.

Aug 05, 2010 Computer Software Cost, Capitalized or Expensed? The cost of payroll or inventory software (purchased) may be treated as an intangible asset provided it meets the capitalization criteria under IAS 38. I am seeking an IFRS guide software that facilitates conversion from local GAAP to IFRS and or serve as an audit tool.

Accounting provides companies with specific rules for financial information management. Capitalizing a project means recording certain costs as an asset. Assets increase a company’s value and economic wealth as reported on its balance sheet. Operational expenses represent capital used to run a business. Expenses reduce a company’s assets in hopes that operations return a profit, increasing value through retained earnings.

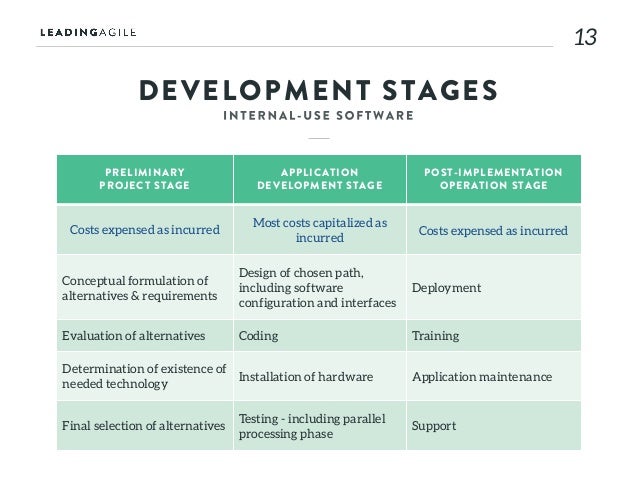

Capitalization

Companies can typically record all costs associated with bringing a project to operation as an asset. For example, the acquisition cost, delivery charges, installation fees and other setup costs fall under capitalization rules. Other projects -- such as building facilities or building -- can capitalize other costs, such as direct labor or materials acquisition associated with the project. Capitalizing these costs allows companies to avoid reporting them as expenses, creating an immediate reduction in net income.

Operational Expense

Operational expenses fall under the accounting concept known as period costs. Companies report period costs as expenses on an accounting period’s income statement. They produce no added value save for the immediate benefit derived immediately at purchase. Utilities, maintenance, executive salary, custodial wages, sales commissions and property taxes are examples of period costs. Companies prefer to avoid unnecessary period costs due to their reduction in net income and future reduction of retained earnings.

Purpose

Ifrs Capitalization Of Assets

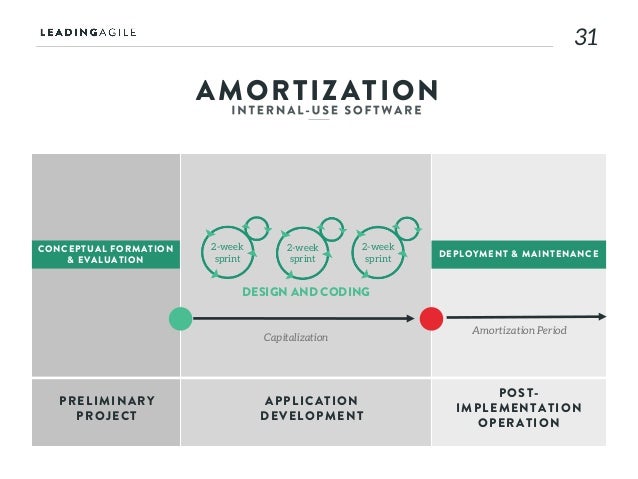

Major projects that result in long-term assets bring value to multiple accounting periods. Companies capitalize these project to reflect the value added. Using the assets, however, will result in a period cost, called depreciation. This represents the amount used from each asset owned by a company. Companies can use a variety of methods to determine depreciation. When posted into the general ledger, depreciation goes into a contra asset account that reflects the asset use for a single accounting period and all time.

Considerations

Improperly recording costs into an asset account is often a major misstatement in accounting information. Companies often attempt to capitalize as many costs as possible into a project’s asset account. This can increase net income, making a company look healthier in financial terms. The long-term costs, however, are detrimental when auditors find these reporting errors. Companies will need to correct the issue and possibly issue new statements for previous accounting periods. Reissuing financial statements can be a serious negative for companies.

Rules For Capitalization Of Software

- 'Fundamental Financial Accounting Concepts'; Thomas P. Edmonds, et al.; 2011